What are the Different Crypto Order Types?

Trading means that assets are exchanged between a seller and a buyer. A trade order or a crypto order is a set of instructions from one party to another to sell a crypto asset like Bitcoin at a given price or price range. It is important to note that the trade orders are associated with a purchase or a sale of crypto assets.

In this blog, we will talk and get to know more about the common crypto order types:

Different Crypto Order Types

1. Limit Orders on Crypto

Here, the trader can set the price limits (maximum and minimum) at which they wish to sell or buy the asset. This order type falls under maker-only or reduce-only type. It is essential to maintain the limit price to 15% of the mark price.

Let us understand this with the help of an example.

Example of limit order type

Supposing you have $100,000 and you want to buy two whole Bitcoins. You can place a limit order for the same. The exchange will look through the order book to find a suitable seller. It comes across person A, who has placed a sell limit order for 2 BTC at $99,800. The exchange will now connect you to Person A to carry out the transaction.

What are limit Orders Advantages?

The upfront advantage of the limit order is that you or the buyer will never pay more than $100,000 for 2 BTC, and person A will get less than $99,800 for 2 BTC.

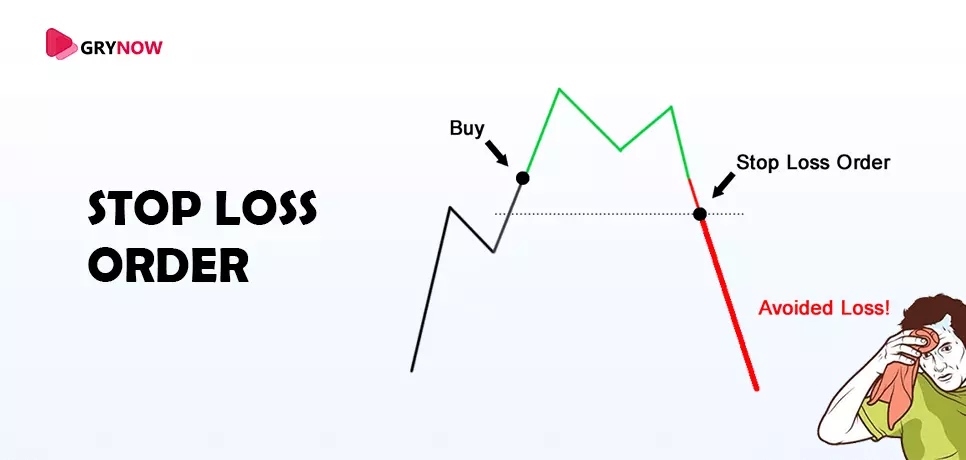

2. Stop-loss limit order

This particular crypto order permits traders to limit their losses. To execute this order type, two prices need to be provided - limit price and stop price. The limit price is the lowest price for executing the order while the stop price is one that will stimulate the limit order to get posted. It is a reduce-only crypto order and traders can get it triggered from the index price, mark price, or the last trade price.

What are stop-limit loss order checks?

- The limit price cannot be more than 10% of the market price. Once the limit is beyond the 10% price collar, the order gets rejected by the trading engine.

- There is usually no requirement of defining the margin in this order type. However, during an order trigger, a margin check will be initiated. In case the margin is insufficient, the order can get rejected.

Example of stop-limit crypto

Suppose the futures price is $5,500. You would want to limit your loss in case of a price decline. Hence, you will put in a stop-loss limit sell order. The stop price can be defined at $5,000 and a limit price at $4,800. If the Futures price declines to $5,000, the stop-sell order is initiated as soon as the price reaches the limit price of $4,800. Thus, the Futures will stop at the price of $4,800 or even higher depending on the demand.

3. Market Order

What are Market Orders?

It is one of the simplest and most-used forms of trade orders. It is an instant order from a seller to an interested buyer or a buyer to a seller for trading in a cryptocurrency. The order is placed at the current price of the cryptocurrency. A simple example of a market order - a seller writing an order for 0.50 BTC by writing down, ‘I wish to sell 0.50 Bitcoin now or at the earliest as possible.’

Characteristics of Market Orders

- Market orders are executed almost immediately as the order is out. If it is not executed instantly, the order cannot get executed.

- The order is said to be filled when the transaction gets completed.

- Market orders are of two types - a. Buy-market order, b. Sell-market orders.

- The only con of a market order on an exchange is that the trader needs to agree to the exchange filling the order at the given best price.

4. Instant Order

As the name implies, an instant order is fulfilled immediately as the order is raised. For example, I wish to buy Bitcoins for $10,000. This is an instant order. As soon as the order is raised, the exchange will search in the order book will be executed to look for sellers to find a match. It will get you matches to ensure that the entire $10,000 is spent. Instant orders can be used for selling, too, by mentioning the number of Bitcoins you wish to sell.

5. Sell Stop order

The selling price can be set either below or above the current market price via a stop order. It is of immense use if the market conditions for the given cryptocurrency are highly volatile and you expect it to change fast. For example, a typical sell stop order is like ‘I want to sell 1 BTC when the price of a single BTC goes below $48,000.’ If you expect the price of BTC to increase, you can use the stop order. For example, when one Bitcoin price is expected to increase from $50,000 to $52,000 in the coming days, you can set a stop order for $51,000, you can make gains meaningfully during the sale process.

6. Trailing stop orders

It is a type of stop order that monitors or traces the price of the cryptocurrency of your interest and then makes adjustments to your order accordingly. An automated crypto order moves or alters the order suitability as per crypto price changes. For example, if you have placed a trailing stop order, it will automatically make adjustments to the trigger price against your stop order, ensuring that you make better gains.

7. Take Profit Market Orders

You can set a target profit price. When the trigger price reaches the profit order price, it will initiate a market order that will have the exchange scan the order book to find a buyer.

Conclusion

These are some of the common crypto order types. There are more such crypto order types that you should be well-versed with if trading in cryptocurrencies.